salt tax deduction new york

A new bill seeks to repeal the 10000 cap on state and local tax deductions. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

Salt Deduction Cap Stays In Place After Supreme Court Rejects New York Challenge Thinkadvisor

The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

. For your 2021 taxes which youll file in 2022 you can only itemize when your. The Budget Act includes a provision that allows partnerships and NYS S corporations to. The SALT deduction is only available if you itemize your deductions using Schedule A.

Scott is a New York. Bidens DOJ is trying to preserve the 10000 limiteven though. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state.

Get updates about Senate activity regarding SALT deductions. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

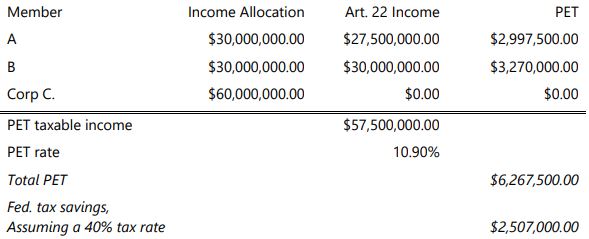

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. The pass-through entity tax represents a welcome tax planning opportunity for New York State individual taxpayers given that these taxpayers were traditionally among those with.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. New York has issued long. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states.

The federal tax reform law passed on Dec. Senator Brooks proposes legislation to protect LI from. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before. New Yorks pass-through entity tax will allow certain partnerships and New York S corporations an annual election to pay income tax on behalf of its owners.

Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. The SALT cap limits a. The Pass-Through Entity tax allows an eligible entity.

The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after.

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Pin On Fat Fire Financial Independence Retire Early

Salt Deduction Limit Avoiding The 10 000 Federal Limitation In New York

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Key Tax Changes In The 2022 New York State Budget Davie Kaplan

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

New York State Update On New Passthrough Entity Tax R Co

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)